- Featured

- Animal Rights

- Anti-racism

- Arts & Culture

- Children

- Climate

- Corporate accountability

- Crime

- Disability rights

- Economic

- Education

- Environment

- Food and Sustainable Production

- Gender Equality

- Governance and Transparency

- Health

- Housing

- LGBT Rights

- Mental health

- Northern Ireland

- Planning

- Privacy and Data Protection

- Rural Inequality

- Social Justice

- Trade

- Transport and Infrastructure

- Workers' Rights

- More

-

Reverse the shutdown of Cape & Clover and allow them to trade.Cape & Clover has become an essential part of our village — a warm, welcoming space that brings people together, supports local connection, and adds genuine value to our community. Shutting them down due to a single complaint does not reflect the wishes of the people who actually use and benefit from their service. We ask Limerick Council to: 1. Review and reverse the shutdown 2. Grant Cape & Clover the appropriate trading licence This small, hardworking business deserves to operate — and our community deserves to keep a service we truly value.765 of 800 SignaturesCreated by Katie Bedford

-

Feed a Student. Build a LeaderSome students don’t need more motivation. They just need a meal. Right now across Ireland, too many students are studying hungry, skipping meals to pay rent or travel to class. Hunger isn’t just physical. It drains focus, energy, and hope. When we feed students, we’re not just helping them survive college. We’re helping them show up fully, to learn, lead, and become who they’re meant to be. This is why we’re building Crave Christi Student Sponsorship, to make sure no student is left behind because of an empty plate. Join us in turning compassion into action. Together, we can make student hunger impossible to ignore. Because hunger shouldn’t be part of the college experience. Not here. Not now.84 of 100 SignaturesCreated by Crave Christi

-

I'm supporting the Global Sumud Flotilla sailing to break the illegal siege of Gaza.The siege and genocide must end. The people of Gaza are relying on regular people like us all to keep going - for them. The Global Sumud Flotilla is a coalition of everyday people—organisers, humanitarians, doctors, artists, clergy, lawyers, and seafarers—who believe in human dignity and the power of nonviolent action.3,851 of 4,000 SignaturesCreated by MyUplift

-

Trump is not welcome in IrelandWe don’t have any power to stop him, but we can show how we feel and maybe he will actually think about what he’s doing if reasonable people around the world let him know. The political opposition in the USA, whose job this really is, are virtually silent109 of 200 SignaturesCreated by Sara Macarthur

-

Save Our Restaurants, Pubs, and Shops: Act Now Before It's Too LateSupport Is Crucial: We cannot wait any longer. The heart of our communities—restaurants, pubs, cafés, and shops—are at risk. Each closure means more jobs lost, more social spaces gone, and greater isolation for all of us. If you work in these industries, your job could be next. We are nearing a tipping point, and without public pressure, the future of our cities, towns and villages are in jeopardy. Sign the petition + Spread the word. We need the help of your voice to demand government action now before it’s too late. Together, we can protect our businesses, our jobs, and our communities. As a customer or fellow worker who values your local coffee shop, retail or hospitality business, realise that we are suffering and that your support and encouragement is important. Follow Us for further action. Follow us on X for updates. Don't let it be another Dark Door. Support material for your business. Posters/POS art work & What's App Badge (make your customers aware & to sign the petition) FUTURE ACTION DARK DOORS DAY A day of mass nationwide voluntary closures. This silent protest will have Restaurants, Pubs, and Shops, will darken their doors to highlight the plight of these sectors. A date will be confirmed soon. Follow us on X for updates. Minister Jack Chambers Message him on X We are Open for Change, Goverment, Where are you?258 of 300 SignaturesCreated by Richard Hanlon

-

Allow those with Irish IRP Cards visa-free EU and UK TravelResidents on IRP cards contribute a lot to taxes in Ireland and deserve the right to have a weekend away or holiday or travel for medical / family emergencies in the United Kingdom and Europe without hindrance.1,767 of 2,000 SignaturesCreated by Grant Halstead

-

Enact the Occupied Territories BillAt this stage in the genocide it is unbelievable that Ireland has a powerful bill, that could help the people of Palestine, waiting in the wings to be enacted since 2018. It took immense effort from many political, academic and legal minds to get the bill to its present position in the legislative process. There is no legal excuse for stalling it any longer. To quote Sen. Frances Black “... it’s not a legal issue, it’s a question of political will. The weight of legal advice makes it clear that we can pursue this if we’re willing to be brave about it – we need to stand up and show leadership”. (Irish times, 13 Jun 2020.) Something has to begin the process of turning the tide on the genocide in Palestine, especially Gaza. The OTB has been identified by multiple organisations nationally and internationally as the single most important and effective action that Ireland as a nation can take, at this time in May 2025. Enacting the OTB can without doubt have a ripple effect throughout the world. Let's throw the pebble in the ocean of support for Palestine and see it do the work it was always intended to achieve.57,977 of 75,000 SignaturesCreated by Dee O Shea

-

Ban Sale Of Used Power Tools At Markets And Car Boot SalesWe think that by giving these tool thieves a platform, the government is enabling them to sell these tools for quick cash. We think that by not taking this action, the government is increasing the pressure on the police, who get calls about tool theft from all over the nation. Insurance companies are also impacted negatively by this crime. People in the trades struggle all over the nation to make ends meet and support their families. This must come to an end. We propose imposing a fine of €10,000 on individuals who vend used power tools at car boot sales or markets, as well as on those who arrange such events. Make it difficult for those who steal tools.21 of 100 SignaturesCreated by Stephen Buckley

-

Reduce the Cost of Gluten-Free FoodsThe high cost of gluten-free foods creates a significant financial burden, hindering coeliacs' ability to access necessary nutrition. By providing financial support, this ensures that coeliacs have equal opportunities to afford these essential dietary items, promoting their overall well-being and health equity.358 of 400 SignaturesCreated by Gill Brennan

-

Save Leixlip Post Office - Ask An Post to Anchor a new site in Confey or the VillageWith a population of almost 17,000 people, Leixlip is a large town. Leixlip needs investment from the local authority, busiesses and An Post to enable it to thrive. The Grant Thornton Report on the Post Office Network stated that the withdrawal of a post office from an area has a significant impact on the remaining businesses due to the impact on local footfall. To assist it in developing employment and educational opportunities, developing its infrastructure, tackling vacancy and dereliction, and putting unused buildings to use. Any efforts to take the post office out of the town centre would be in stark contrast to what Leixlip needs. Leixlip has demographics that mean more people depend on services like those currently provided by An Post, and therefore need easily accessible services. Anything but a town centre location cannot be accepted, and the people of Leixlip need assurances that its post office will remain in the town centre.942 of 1,000 SignaturesCreated by Nuala Killeen

-

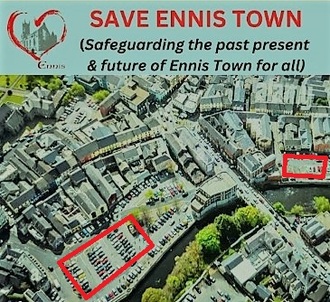

Don’t build on Riverside Car Parks in EnnisClare County Council has developed a strategy to develop Ennis and set up a company, Ennis 2040 DAC, to implement it. The strategy aims to enable Ennis to prosper as a vibrant civic, commercial, cultural and residential centre. We support these aims but NOT the project they are starting on now - a multi-storey commercial block on Abbey Street car park and a later project for two commercial blocks on Parnell Street car park. We ask Clare County Council to stop the plan to build on our riverside car parks because: • It removes car parking that our businesses and mobility impaired people need – a vibrant town needs vibrant businesses • It is a speculative development for high cost office and large retail that could end up as a white elephant in a prime location • It hands valuable open public space to private interests, space that is ideal place for our community to gather and enjoy river and town views • This generic development in the heart of the town could destroy what people love about Ennis - a medieval town with narrow, winding streets and laneways with the beautiful river Fergus meandering through it We ask Clare County Council not to transfer this public property to Ennis 2040 DAC, a company that can sell it on without consent by the county council or councillors. There are many vacant sites that exist in Ennis that are ideal for regeneration and development. We ask Clare County Council and Ennis 2040 DAC to focus on these. Do you want large private buildings on our riverside car parks? If not, please sign our petition and share it with others who also want to stop this madness. You can also sign this petition in person at many of the businesses in Ennis Town Save Ennis Town is a group drawn from the general public including community, business, retail and political representatives. It formed after a public meeting on 4th May 2023 in the Temple Gate Hotel with over 200 people, all concerned about elements of the Ennis 2040 plans. We aim to have constructive engagement with Ennis 2040 DAC and develop a plan that will enhance our town for everyone.1,378 of 2,000 SignaturesCreated by Save Ennis Town

-

Increase VAT Threshold for Sole TradersEvery minute, the Irish government is making a huge amount of money by charging people different taxes, including VAT. Currently, the VAT threshold for big companies and small businesses is €75,000 on selling products and €37,500 on providing services. When a sole trader who provides services reaches €37,500 annual turnover, they are obliged to register for VAT and start charging their clients that tax. This means the business owner has no choice but to: 1. Increase their prices by 23% and more than likely lose a number of existing and future clients. 2. Or include VAT in their current prices and substantially reduce their hard-earned income. 3. Or increase their prices slightly (by 10-12%) and still encounter the above. In the current situation, where the VAT threshold is €37,500, it is so very unfair for the hard-working small businesses in Ireland to give away their hard-earned money to the government. But it's equally unfair for their customers to pay that VAT if they can't claim it back! The VAT threshold on services must be increased to the same or at least a close value of €75,000 so that goods suppliers and service providers have an equal chance of thriving. It’s so much easier to include the whole (or almost whole) amount of VAT in the service fees when your annual turnover is €75,000 or more. Isn’t that right? The Irish government should give all companies in Ireland, including sole traders, an equal chance to get well established. In the United Kingdom, the VAT threshold is £85,000 for both goods suppliers and service providers. If this works in the UK, it will work in Ireland. So, if you agree with me, my friend, simply sign this petition and feel free to share it on social media and via email with your friends. Together, we can make it happen!8 of 100 SignaturesCreated by Richard Kolodziej

%20(1).png)