100 signatures reached

To: Minister of Finance - Ireland

Reform the 41% Capital Gains Tax on Index Funds for Irish Residents

𝗧𝗼: The Minister for Finance, The Department of Finance, and The Irish Government.

𝗦𝘂𝗯𝗷𝗲𝗰𝘁: Unfair Capital Gains Tax on Index Funds for Irish Residents vs. Corporate Tax Benefits for Fund Providers.

Dear Minister,

We, the undersigned, are writing to express our deep concern regarding the punitive 41% capital gains tax (CGT) levied on Irish residents investing in exchange-traded funds (ETFs). This policy significantly hinders long-term wealth building for individuals while simultaneously offering highly favorable tax treatment to financial institutions domiciling these very funds in Ireland.

𝗦𝘂𝗯𝗷𝗲𝗰𝘁: Unfair Capital Gains Tax on Index Funds for Irish Residents vs. Corporate Tax Benefits for Fund Providers.

Dear Minister,

We, the undersigned, are writing to express our deep concern regarding the punitive 41% capital gains tax (CGT) levied on Irish residents investing in exchange-traded funds (ETFs). This policy significantly hinders long-term wealth building for individuals while simultaneously offering highly favorable tax treatment to financial institutions domiciling these very funds in Ireland.

Why is this important?

𝗧𝗵𝗲 𝗜𝘀𝘀𝘂𝗲

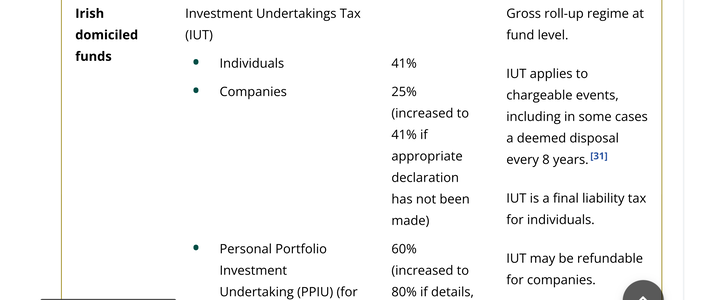

1. A 41% CGT on Irish Domiciled Index Funds

• Irish tax residents face an automatic 41% capital gains tax on ETFs, which must be paid every 8 years or upon sale—whichever comes first.

• This significantly reduces the power of compound growth, placing Irish investors at a disadvantage compared to those in other jurisdictions.

2. A 12.5% Corporate Tax for Fund Providers

• Ireland has positioned itself as a global hub for Index Fund providers, offering an attractive 12.5% corporate tax rate to financial institutions managing these funds.

• While global investors benefit from tax efficiency, Irish residents—who are the very taxpayers funding public services—are penalized for investing in the same products.

3. A Barrier to Financial Independence

• Individual investors in Ireland cannot efficiently build diversified, tax-efficient portfolios.

• Many must either over-rely on employer pension schemes (which often have limited investment options) or face punitive taxation on self-directed investing.

𝗧𝗵𝗲 𝗦𝗼𝗹𝘂𝘁𝗶𝗼𝗻

We urge the Irish government to reform the tax treatment of Index Funds for individual investors by:

• Aligning the tax treatment of Index Funds (ETFs) with standard capital gains tax rates (33%) applicable to other investments (which is still exceptionally high!)

• Eliminating the deemed disposal rule every 8 years, which arbitrarily disrupts long-term investment strategies.

• Introducing a tax-exempt allowance or incentive for individuals investing in diversified, long-term portfolios.

• Currently, you are encouraging retail DIY investors to individually pick stocks as it is more tax advantageous but far riskier, rather than encouraging individuals to invest in safer diversified index funds such as ETFs.

• When investors pick individual stocks, many make losses and use those losses to reduce their taxable gains. With ETFs, investors are more likely to see steady profits because they are diversified. More profits mean more taxable gains, leading to higher tax revenue for the government creating a win/win for both investor and government!

1. A 41% CGT on Irish Domiciled Index Funds

• Irish tax residents face an automatic 41% capital gains tax on ETFs, which must be paid every 8 years or upon sale—whichever comes first.

• This significantly reduces the power of compound growth, placing Irish investors at a disadvantage compared to those in other jurisdictions.

2. A 12.5% Corporate Tax for Fund Providers

• Ireland has positioned itself as a global hub for Index Fund providers, offering an attractive 12.5% corporate tax rate to financial institutions managing these funds.

• While global investors benefit from tax efficiency, Irish residents—who are the very taxpayers funding public services—are penalized for investing in the same products.

3. A Barrier to Financial Independence

• Individual investors in Ireland cannot efficiently build diversified, tax-efficient portfolios.

• Many must either over-rely on employer pension schemes (which often have limited investment options) or face punitive taxation on self-directed investing.

𝗧𝗵𝗲 𝗦𝗼𝗹𝘂𝘁𝗶𝗼𝗻

We urge the Irish government to reform the tax treatment of Index Funds for individual investors by:

• Aligning the tax treatment of Index Funds (ETFs) with standard capital gains tax rates (33%) applicable to other investments (which is still exceptionally high!)

• Eliminating the deemed disposal rule every 8 years, which arbitrarily disrupts long-term investment strategies.

• Introducing a tax-exempt allowance or incentive for individuals investing in diversified, long-term portfolios.

• Currently, you are encouraging retail DIY investors to individually pick stocks as it is more tax advantageous but far riskier, rather than encouraging individuals to invest in safer diversified index funds such as ETFs.

• When investors pick individual stocks, many make losses and use those losses to reduce their taxable gains. With ETFs, investors are more likely to see steady profits because they are diversified. More profits mean more taxable gains, leading to higher tax revenue for the government creating a win/win for both investor and government!

𝗪𝗵𝘆 𝗧𝗵𝗶𝘀 𝗠𝗮𝘁𝘁𝗲𝗿𝘀

• Irish residents should not be punished for investing prudently in diversified, long-term financial products.

• Encouraging financial literacy and responsible investing will reduce dependence on state pensions.

• A fair tax structure will empower individuals to build wealth sustainably, benefiting both the economy and society.

We call on the Irish government to correct this fundamental inequity and ensure that Irish residents can invest in a fair and reasonable tax environment.

How it will be delivered

Through online formats